Table of contents

- AI Podcast Version

- Introduction

- Economics and the Use of Resources

- The Global Financial Crisis (GFC)

- Equality is not a useful aim

- Freedom of action and inequality

- Thomas Piketty

- Useful vs Inefficient Inequalities

- The Physics of Freedom

- Participatory democracy

- Further reading

- Footnotes

Beautiful inequality, created from “Solar System Painting”, NASA, 2008 CE, public domain.

Note: have added a few additional data points and more info on Econophysics following first publication of this article.

AI Podcast Version

I have also created an AI podcast version of this article with some additional sources:

Introduction

Life in this universe is only possible due to inequality and so we must be very careful to distinguish inequality and inequity and to clarify what is meant by inequality.

A useful ethical framework must focus on scientific and objective qualities, principles and ethics that can hopefully be developed to withstand the test of time. This requires that the terms used have their most long-standing and basic meaning insofar as possible.

Unfortunately, it is difficult to use the term inequality in its non-ethical and relative sense (i.e., there being two or more things that are not equal, such as 2 versus 5 or 100ºC versus 50ºC) without risking straying into the more pejorative sense in which it is often used (such as the inequitable availability of opportunity between people of different race, region, religion, physical ability, gender or socio-economic status).1 It is however necessary to use inequality in its morally neutral sense if we are to be rational in our discourse and investigations.

As considered in respect of evolutionary theory and negative entropy and the use of energy by life-forms, we must not confuse the potential positive value of some inequality (difference) between things and life-forms with the likely negative value of some inequity between life-forms.

Inequality here is simply, in principle, a form of differentiation between any things allowing more freedom for useful work to potentially be done. Inequity is a form of unjust access to resources, unjust treatment or any other form of unfair discrimination, i.e., discrimination that is not inherently justifiable and provides less freedom for useful work to potentially be done.

“Absolute freedom mocks at justice. Absolute justice denies freedom. To be fruitful, the two ideas must find their limits in each other.”2

(Albert Camus)

Extremes of any ideology (e.g., liberalism) can become functionally indistinguishable from their purported enemies, since they can restrict the freedom to do useful things and exercise agency. Any overly politically correct discourse and approach therefore risks creating inequitable situations despite the protestation that it is being used to make things fairer. We must avoid extremes in any political or ethical position.

Any particular ethical or political position is relative (and is in fact located on the outside of a circular spectrum). Only a suitable framework for any compossible (capable of mutually existing) ethical positions can be more universal.

Economics and the Use of Resources

“… to feel much for others and little for ourselves, that to restrain our selfish, and to indulge our benevolent affections, constitutes the perfection of human nature; and can alone produce among mankind that harmony of sentiments and passions in which consists their whole grace and propriety.” 3

(Adam Smith)

As we see with Pareto-optimal equilibria (e.g. prisoner’s dilemma), it is not the case that reliance on each participant to optimise for their own self-interest is better for each or for all. Pareto-optimal outcomes are unlikely to be the most beneficial in aggregate, since in most cases the starting position will be one where some agents have an extraordinarily inequitable level of control of existing resources. There are many circumstances where a decision needs to be made whereby:

- one being, or a small group of beings may be worse off

- it would be significantly beneficial for many others (and sometimes for other species)

- it would also increase the aggregate total payoff available to affected life-forms (‘utility-optimal’)

The practical need for centralisation of power often required to achieve utility-optimal solutions – whether by communism, dictatorship or representative democracies – and the problems inherent to centralisation of power have meant that securing such utility-optimal outcomes has not been easy. It has been achieved to varying extents from time to time, e.g., in some benevolent dictatorships or in crisis periods when societies have seen the bigger picture and coordinated more collectively.4

Any centralised system of allocation of resources is expected to eventually fail, given the risk of capture of the system by a small number of selfish individuals or of over-ideologically driven decision-making. This leads to resource decisions and laws that are neither Pareto-optimal nor utility-optimal. We must also allow for differences in wealth, as inequality allows for differentiation that has utility. In addition, over-reliance on Adam Smith’s notion of the ‘invisible hand’ (in an almost offhand reference) can lead to disastrous results in aggregate. It also appears that Smith did not say or mean what free-market proponents have claimed.

“The general caricature of what Smith meant the phrase to mean is that if we just leave markets to be free then she’ll be right. Which is, of course, not something that Smith ever intimated let alone stated openly.”5

(Tim Worstall)

In The Wealth of Nations, Smith gives examples of cases in which central government intervention is considered appropriate and those in which it is not. In any event, discussion of economic theory has moved far beyond simplistic laissez faire approaches (e.g., Modern Monetary Theory), though the current state of economic theory is very confused and confusing. This is likely to be because the state and central banks have taken an increasingly dominant role in the economy on behalf of the private sector.

We cannot afford to be religious conservatives on any of these matters as between a poorly managed centralised command economy and a freer market, there is likely to continue to be value in understanding the role of a decentralised approach to allow more optimal equilibria to take place (but only to the extent that they actually do). It is, however, impossible to see how we can find optimal solutions for the use of resources if we allow a free-for-all by the strongest or most aggressive – e.g., on matters of deforestation, energy production, pollution, wildlife protection and the destruction of natural habitats and the local economies surrounding them.

“The reason they call it the American Dream is because you have to be asleep to believe it”6

(George Carlin)

In addition, the ‘invisible hand’ today appears to have given way to a coordinated grab; the dominant force no longer appears to be an unintentional emergent force (if it ever was). The economic and financial system looks more like it is shaped by a coordinated effort by a few powerful entities and individuals to maintain and strengthen their control over various resources and domains – against the interests of the many.

“Wealth was the power to set things and people in motion; and in America, therefore, wealth came to be frankly regarded as the breath of God, the divine spirit immanent in man. God was the supreme Boss, the universal Employer.”7

(Olaf Stapledon)

It is notable that the Global Financial Crisis, and more importantly the response to it by the political establishment and central banks, has coincided with a rapid acceleration of wealth inequality (particularly in the USA). Likewise the powers that be did not miss the chance to accelerate these inequalities during and post-COVID (‘never let a crisis go to waste’!).

Inequality and the Covid crisis in the United Kingdom | Institute for Fiscal Studies

Economic inequality has deepened during the pandemic. That doesn’t mean it can’t be fixed

“These interactive charts expose how the Covid-19 pandemic – and failed policy responses – are exacerbating class, race, & gender inequality.”1

The Global Financial Crisis (GFC)

The transfer of the cost of risk-taking behaviour and liability to the public happened because of the implementation of protection from failure and underwriting for much of the leaders of the risk-taking private sector. This increase in inequality looks like astonishing coincidence, staggering ineptitude or, more likely, a finely orchestrated plan – especially given the ability of governments to choose monetary and fiscal policies that could have benefited a greater number of people in aggregate. A choice was made to make the rich richer.

The distribution of wealth is increasingly suboptimal (to put it mildly) and is now tending towards disequilibrium including for the very wealthy (that currently benefit the most) – as the risks of social and economic breakdown rise (largely due to such blatantly unequal and inefficient allocation of resources).

“Bill Gates – the second richest person in the world with a current net worth of $108.8 billion, according to Forbes – says his extreme wealth is not fair.”8

The politicisation of the economy and financialisation of politics increases the potentially nefarious role of central banks in working with investment houses, commercial banks and financial intermediaries. The overall lack of transparency and accountability pollutes the political and financial systems of the Western world. It is best (healthier, too) to try to remain open to the possibility that much of this is a manifestation of long-standing and worsening structural defects as much as any intentional conspiracy. Greed for money and power driven by self-centredness must, however, be the expected prime drivers of such behaviour.

“The problem is that we all too often have socialism for the rich and rugged free enterprise capitalism for the poor.”9

(Martin Luther King, Jr.)

Given the risks of poor judgement, corruption and capture of the system by the few that have greater resources, we need economic decision-making processes that better benefits the many. We have seen blockchain unlock some of the benefits of a decentralised approach to value and finance (at least in principle!). It is time for economics and politics to face the same fate.

We should therefore look to synthesise the benefits of a decentralised structure for decision-making with the benefits of a significant degree of aggregated power to effect such decisions (e.g., purchasing power, economic power, legal power). This does not require that each person has the same wealth, but it would inevitably be redistributive in its effects.

Let us look at the current distribution of wealth in the USA on a simplified basis to see what might be credibly said about this ‘winner-takes-all’ society. The US population is approximately 330 million, of whom approximately 240 million are statistically relevant for wealth purposes. Estimates of current distributions have the top 1% owning 15 times or more as much as the bottom 50%, and approximately the same as the bottom 90%.

“We find that the top 0.1% share of wealth increased from 7% to 14% from 1978 to 2016. While this rise is half as large as prior estimates, wealth is very concentrated: the top 1% holds nearly as much wealth as the bottom 90%.”10

Based on these 2016 figures, the top 0.01% appear to own somewhere around $7–8 trillion and the top 1% around $26 trillion. The bottom 90% own around $24 trillion.11 Given central bank and government support of the wealthy and asset-owning classes, I would expect that since 2016 the situation has worsened for the bottom 90% and improved for the top 10%, 1% and 0.1%.

Simply put, this means around 24,000 people in the USA now own about the same in financial assets (wealth) as 120 million people. This level of inequality was last seen in the Great Depression, a period which ushered in extreme political instability and ultimately the death of many millions of people in a world war.

It is very difficult to see what benefit this environment has for most Americans. In addition, greater wealth spread among a wider group of participants would likely lead to greater economic activity than that which applies when wealth is so concentrated. When even the winner in a ‘winner-takes-all’ economy warns that it is broken and is failing to be equitable and useful, one should take serious note.

The current economic system and distribution of wealth does not provide a suitable backdrop for an ethical framework that seeks to apportion value more wisely, efficiently and fairly between different life-forms and species. When there is such disproportionate allocation of resources and power among beings of the same species, we can expect no wider step-change in allocations of resources between species. This is accelerating climate change and the 6th great extinction:

Link: https://www.worldwildlife.org/stories/what-is-the-sixth-mass-extinction-and-what-can-we-do-about-it

Despite the risks, we are in need of a forest fire in our financial and political systems. It is the only way (other than another global war) that this terrible equilibrium will resolve.

Equality is not a useful aim

It is fundamentally important to note that what is being proposed is not any form of equality of wealth. This would be unnatural and counter-productive (even if possible). In fact, wealth distribution appears to also have an entropic nature and is normal when distributed across diverse holders in an unequal distribution (i.e., the maximum possible number of different microstates).13

A suitable ethical framework must make clear that inequality in its technical sense is not unethical; unfortunately, the term has been hijacked to some extent and is often confused with inequity. To reiterate, inequalities – differences between things, as represented by evolution and the use of free energy – are a requirement of life and useful action or work.

“the Forbes 400 paints a far different picture. Between the first computation in 1982 and today, the wealth of the 400 increased 29-fold – from $93 billion to $2.7 trillion – while many millions of hardworking citizens remained stuck on an economic treadmill. During this period, the tsunami of wealth didn’t trickle down. It surged upward.”14

(Warren Buffet)

In addition, we need to ensure that we measure actual inequality within the context of each society and not just individual purchasing power in the abstract. A good example of the distinction between general inequality and inequitable inequality can be found in the concept of ‘augmented wealth’ within Scandinavian nations. People often point out that countries like Sweden or Denmark have surprisingly high levels of wealth inequality when looking strictly at private net worth (shares, housing and cash). However, this statistical inequality does not translate into true inequity.These nations have robust social safety nets (healthcare, education, and generous pensions) and so citizens feel less need to accumulate private capital for self-preservation. When economists adjust for this by measuring ‘augmented wealth’ (private assets plus the value of future public entitlements), the inequality gap shrinks dramatically. This illustrates that a society can tolerate (and flourish with) statistical inequality as long as there is much less inequity in the access to the resources required for a good life.

Freedom of action and inequality

The ethical framework should value economic systems with the greatest amount of freedom of action that is consistent with the axioms. Inequity is not consistent, since it gives rise to reduced freedom of action, including the potential to do useful work.

The remedy for dealing with inequity will likely be in the following forms.

- Wealth generation and ownership will be constrained such that it does not create dynastic levels of wealth that transfer significant wealth within families further than two or three generations. This requires an annual transfer of assets into a sovereign fund.15

- Public taxation (particularly capital gains tax) and spending will be aimed at redressing inequity whilst maintaining the ability for useful economic inequality.

- Income support may be required to meet the challenges of the erosion of the labour base by technology.

- Constraints on the maximum inequality that is consistent with useful freedom of action by all of the population will be modelled and enforced.

“A dynastic system where you can pass vast wealth along to your children is not good for anyone; the next generation doesn’t end up with the same incentive to work hard and contribute to the economy.”

(Bill Gates)

Such an approach would represent a very significant change to the current structure and so would be resisted fiercely by many of those people currently holding the most wealth and power. It may also face resistance from many who are not at the top of the financial food chain on the basis that it represents a major cultural shift away from the role and importance of the ‘family’. We should expect very adverse media. Nevertheless, even some of the winners in the current system have reached a similar conclusion about its deficiencies.

“Gates said it’s one of the reasons he co-founded the Giving Pledge with Warren Buffett (who has also said the rich should pay higher taxes). The Giving Pledge invites billionaires to commit to giving away the majority of their money to charity, and both the Gates and Buffett have made the pledge.”16

In the absence of a post-scarcity world, it is inevitable that humans will need to tackle these issues soon if we are to reach a sufficiently efficient and successful high level of economic and social success. This higher level will support greater opportunities for a much larger number of people that are currently not able to add as much value as they otherwise would. The reason for not advocating wholesale equality is simply that some people are better able to use resources than others.

Thomas Piketty

Piketty is a leader in this area and looks at wealth and income inequality. On income inequality (often modelled using the Gini coefficient) Pikkety’s view is that:

“The question of what might represent “acceptable levels” of income disparity… is “clearly a question that a democratic process and public deliberation should deicide”… he proposes a ratio between the poorest and richest somewhere in the order of 1 to 3 or 1 to 10. These levels can accommodate diversity of aspirations, while maintaining the incentives “necessary for social and economic organization”. Nothing, economically or socially, justifies ratios of 1 to 50 or 1 to 100.“

Is inequality a natural phenomenon? Thomas Piketty argues it isn’t – and proposes a way forward

He also ties the problems of dangerous levels of inequality with the climate and environmental crisis we face:

“There’s no way we can preserve […] planetary habitability in the long run if we don’t address our inequality challenge at the same time.“

Useful vs Inefficient Inequalities

Our ability collectively to undertake useful freedom of action requires some of the resources to be concentrated in those people that can achieve useful and interesting outcomes with them. However, we need to be more honest and realistic about the levels of concentration, i.e., where that switches from being useful to being a drawback on aggregate freedom of action. By way of experiment, we should model to what extent different distributions of wealth are likely to increase or decrease the freedom of action available to all participants.

At one end of the spectrum, we could have a society of 1 million people where all disposable income and wealth is concentrated in one person’s hands. It should be immediately obvious that, even if that person is Jeff Bezos, such a distribution makes it very unlikely that the rest of the population will be able to undertake potentially useful and unusual behaviour. In this case, nearly the entire freedom of action in economic terms is collapsed into one life-form and the system reduces the aggregate freedom of action (since all extension of that attribute is limited to one member of the population). This is a dangerous disequilibrium and mirrors the one that currently applies between humans and other species.

At the other end of the spectrum, the wealth could be shared equally between the 1 million people. In this case it should be obvious that the ability of an individual or a small group within that population to do anything extraordinarily unusual and useful diminishes, since that freedom of action would likely require them to obtain a larger share of the resources (e.g., to research and then build new energy technologies).

“Winner-take-all markets tend to discourage collaboration and cooperation. The winners have incentive to keep their knowledge and new data to themselves. Patents and copyright are liberally used to suppress any serious competition. Skilled workers are snapped up the second they leave education, and have powerful inducements to stay working for the winners. The result is a prisoner’s dilemma-style situation. Although collaboration may be best for everyone, each individual organization benefits from being selfish. As a result, no one collaborates, they just compete.”17

As with the ethical validity of any relative situation, no one is able to assume a privileged universal position and determine alone, godlike, what the most ethically useful distribution of resources is. It requires collective decision-making that is based on objective foundations, stripped of dogma and based on evidence. It requires that the people with the most resources do not control the means of communication, since otherwise the information made available will inevitably be biased to reinforce their control of resources, even if that is not optimal (in fact, especially when it is not).

We require a higher degree of honesty and humility about the effectiveness of central versus distributed resource allocation and management. Our ability to explore other planets and solar systems and enhance our capabilities with artificial intelligence is predicated on reaching a higher level of ethical standards and economic efficiency. The consequences of failure become ever more extreme as our technological capabilities grow.

Decentralised secure information channels and decision-making processes are required that avoid single points of failure and the capture of economic, political and legal structures. Existing structures will undermine the ability to determine and execute utility-optimal decisions.

The Physics of Freedom

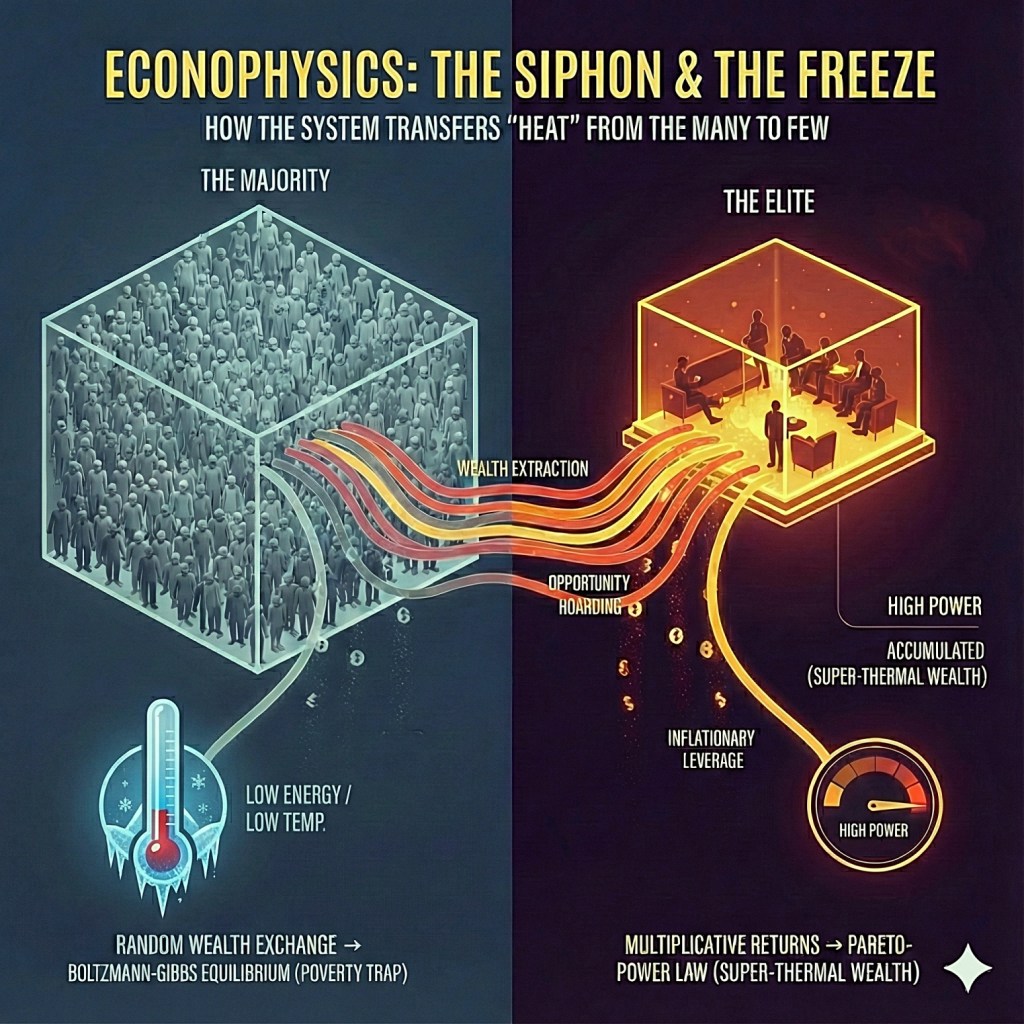

A physics based (entropy) analysis of the optimal distribution of income and wealth would give rise to much greater aggregate freedom of action. It needs to balance two opposing forces:

- Thermodynamic Entropy (the physics of unstructured distribution); and

- Human Capability (the economics of agency).

If we treat 10 billion people on planet Earth purely as particles in a system and ask, “what distribution allows for the maximum number of possible micro-states?” (the physics definition of entropy), the answer is derived from the Boltzmann-Gibbs distribution.

- The Physics: In a system maximising entropy (randomness and movement) with a fixed amount of total energy (wealth), the natural distribution is exponential.

- The Number: This mathematically results in a Gini coefficient of exactly 0.5.

Interestingly a 0.50 score represents maximum thermodynamic freedom (randomness), but it is also close to the most equal society we can likely develop (even though it does not fully maximise all human freedom).

In a human economy, where 0.0 is maximum inequality and 1.0 maximum equality, a 0.50 distribution implies a very large population of poor individuals with limited agency (low capability). However, when allowing for age and other factors it is actually a huge improvement in where currently are. All Western societies are operating far below 0.50.

Note on Measuring Freedom:To visualize this, we can invert the standard Gini Coefficient (where 0 is equality and 1 is inequality) to create a Freedom of Action (FOA) score (where 1 is equal opportunity) – e.g. the current US Score = 0.17 on the FOA score (Gini 0.83). Evidence suggests peak Freedom of Action is likely around 0.55 (a Wealth Gini of 0.45). This represents the natural state of a dynamic, high-energy and egalitarian society and economy which is not rigged to pull free energy away from the vast majority of people for the benefit of a very few.

For human beings, “freedom of action” is not just the absence of constraint or coercion, but the presence of effective capability (the ability and power to do something, to move, to take risks, to innovate). If we model different ranges we see the effects:

- High Inequality: Aggregate freedom drops because the bottom 40-50% of the population lacks the resources to exercise agency. They are trapped by necessity like slaves. The “freedom” of the few billionaires does not mathematically offset the lack of freedom of the billions in poverty. The very rich siphon off energy (wealth) from the rest.

- Too High Equality: Aggregate freedom drops because the system becomes too rigid. You would need authoritarian redistribution that crushes incentives for small groups of individuals to collectively innovate. This also shrinks the total energy and wealth available to be shared.

The Optimal Equality Target: 0.5 (Gini 0.5)

The range that maximises aggregate freedom —defined as the highest combination of personal autonomy, social mobility, and economic choice — is a score of 0.5 on the freedom of action scale. For example, if we take the USA at the moment the current distribution which is around 0.33 in economic freedom of action we would:

- Eliminate poverty traps

- Maintain innovation incentives

- Maximised total societal freedom

The wealthy would still have plenty (in the USA nearly $10M average wealth for the top 1%), so their freedom barely decreases however the middle class and the poor gain a massive increase in freedom from the current system of effective economic slavery. In the USA , the society’s total aggregate freedom of action would increase massively and this would be reflected in economic growth benefiting all.

The Life-Time Analogy

Imagine you have 10 people and each has an average life-span of 100 years and a maximum theoretical life-span of 150 years. These years are “life freedom”.

Now imagine a society was dominated by one person and they decided that in order for him to reach the 150 years theoretical maximum the group would need to order things such that the other 9 people reduced their life span (e.g. due to poverty, hunger, ill-health, slavery) and so the distribution looked like this:

- Maximum Actual Longevity: One person = 150 years

- Average Longevity for remaining population: Nine persons = 50 years each

- Total Life Years = 600 years

One person has transferred 50 years of life to themselves at a cost of an aggregate loss of 400 years of life from the total population. Aggregate Loss of Life Time: 400 years compared to equal society (1,000 years)

Waste Ratio: One person gained 50 years, society lost 400 (8:1 destruction)

Now redo this life example with a extremely equal societal with a freedom score of 0.73 (Gini 0.27):

- One person: 120 years (they are still rewarded for success)

- Nine people: 90 years each (secure, healthy, thriving)

- Total Life Time: 930 years

- Aggregate Loss: 70 years compared to perfect equality (1,000 years)

Waste Ratio: One person gained 20 years, society lost just 70 years in total.

Inequality isn’t just unfair—it’s extraordinarily painful and wasteful. A balanced freedom model massively increases total societal “life-freedom” while maintaining the incentives needed for a dynamic, innovative economy and for billions of people to enjoy their lives.

In reality, given age and other human factors, the maximum entropy target of 0.5 would be an extraordinary achievement given that we are currently close to 0.2 in places like the UK and the USA.

Ironically*, a maximally entropic distribution of wealth would be proof that a system is not rigged and is being carefully managed for the benefit of the whole society – which will also benefit all life on Earth.

*Ironic because it takes continual effort (energy) to stop the wealthy gaming the system.

Participatory democracy

We need to move forwards towards the historic concept and practice of participatory democracy whereby everyone can vote on all major issues (democracy literally means ‘people power’) and we are careful as to how we choose administrators (e.g. perhaps chosen randomly) and perhaps they must be rotated frequently. We need to protect the people from politicians and the corruption endemic in our current symbolic democratic processes. The process will require participatory democracy and administrators (civil servants) but these may even need to be chosen randomly (sortition) as in ancient Greece, where they used various lottery machines (Kleroterians) to choose their officials.

“In modern times, it is understood that elections are the very essence of democracy, so it is reasonable to expect that the first democrats, the Athenians, also held elections to determine who their leaders would be. This assumption is correct to the extent that the Athenians … did so before they became a democracy… the Athenians viewed electoral leadership as a version of oligarchy. It was rule by the few, and the fact that those few were subject to change once in a while did nothing to alter that fundamental point … The Athenians, and their neighbours, agreed that in a true democracy, the people did not obey the decisions taken by those empowered to do so via election or any other means. Instead they took all decisions themselves through two important bodies: the Assembly and the courts.”18

(Roslyn Fuller)

We need to create the architecture for operating a consensus engine. We must also consider the use of suitable power ratios to ensure wealth and income is never too concentrated.

Is there a maximum and minimum ration for sharing resources that is more consistent with supporting freedom of action and diversity?

And, if so, how should it be distributed?

Our current financial and economic systems are very unbalanced, but not nearly as much as our current treatment of the biosphere and all non-human life-forms.

“Why were they prepared to go to extraordinary lengths to rescue the financial system, but completely fail to grasp what needs to be done to rescue our life support systems? Is it because the climate, unlike the banks, doesn’t fund their campaigns for re-election? Is it because oceans and rainforests can’t lobby them? Are we to face the prospect of systemic environmental collapse because averting it doesn’t appeal to their immediate self-interest?”19

(George Monbiot)

Further reading

Direct Decentralised Democracy

Footnotes

1 In many cases this may simply be the randomness of the family you are born into or brought up in, but in some cases it also means ‘class’, ‘caste’ or similar social stratifications.

2 The Rebel, 1951 CE, trans. by Anthony Bower. By ‘absolute justice’ Camus meant something quite specific which I take to mean ‘absolute equality’: “Absolute freedom is the right of the strongest to dominate”, Camus wrote, while “absolute justice is achieved by the suppression of all contradiction: therefore it destroys freedom” (Sam Dresser, “How Camus and Sartre Split Over the Question of How to be Free”, The Wire, 26 February 2017 CE).

3The Theory of Moral Sentiments, 1759 CE.

4 It is no coincidence that the UK’s free at the point of use National Health Service is a child of World War II.

5 “Adam Smith’s Invisible Hand Really Isn’t What You Think It Is”, Forbes, 11 March 2015 CE.

6 Life is Worth Losing, HBO, 2005 CE.

7 Last and First Men: A Story of the Near and Far Future, 1930 CE. Olaf Stapledon is a lesser-known sci-fi writer and British philosopher who wrote a number of stories that were remarkable in spanning billions of years or even the whole of life in the universe (see, e.g., his novel Star Maker, 1937 CE).

8 Catherine Clifford, “Bill Gates: America’s tax system is not fair”, CNBC, 3 January 2020 CE.

9 Wikipedia, “Socialism for the rich and capitalism for the poor”. This phrase may have originated from Charles Abrams.

10 Matthew Smith, Owen Zidar and Eric Zwick, “Top Wealth in America: New Estimates and Implications for Taxing the Rich”, 24 April 2020 CE.

11 Howard R. Gold, “Never mind the 1 percent. Let’s talk about the 0.01 percent”, Chicago Booth Review, 2017 CE. Note: wealth figures are notoriously difficult to ascertain so there will always be significant variations in any reported figures.

12 Isabel V. Sawhill and Christopher Pulliam, “Six Fact about Wealth in the United States”, Brookings, 25 June 2019 CE.

13 See, for example: Wikipedia, “Pareto Principles”, “Zipf’s Law” and “Benford’s Law”. Suggested reading: Oded Kafri and Hava Kafri, Entropy – God’s Dice Game, 2013 CE.

14 Warren Buffett, “Warren Buffett Shares the Secrets to Wealth in America”, Time, 4 January 2018 CE.

15 Catherine Clifford, “Bill Gates: America’s tax system is not fair”, CNBC, 3 January 2020 CE.

16 Ibid. See also PND, “Warren Buffett to Give Bulk of Fortune to Gates Foundation”, Candid, 27 June 2006 CE: “Warren Buffett, the second wealthiest man in the country, will donate the bulk of his $44 billion fortune to the foundation of the wealthiest, the Bill & Melinda Gates Foundation, and four other philanthropies starting in July, The New York Times reports. Buffett, chairman of Berkshire Hathaway, Inc., plans to contribute 85 percent – about $37.4 billion – of his Berkshire stock to charity, with approximately $31 billion directed to the Gates Foundation, effectively doubling the asset base of the largest foundation in the United States.”

17 fs blog, “Winner Takes it All: How Markets Favor the Few at the Expense of the Many”, 2018 CE.

18 Beasts and Gods, 2015 CE.

Leave a comment